city of mobile al sales tax application

Dry Cleaning Registration Fees. City of Mobile Alcoholic Beverage Application.

Sales Tax Alabama Department Of Revenue

Box 1750 Foley AL 36536.

. What is the sales tax rate in Mobile Alabama. Contractors Gross Receipts Tax. File sales tax faster with Avalara Returns for Small Business.

Prepared Application For Sales Tax Permit AndOr Use Tax Permit - Form AP-201 Options for Getting Your Business License Forms in Mobile AL Option 1. Ad Automate sales tax preparation and filing and get back to selling. Food Beverage Tax Form 7.

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd. The minimum combined 2022 sales tax rate for Mobile Alabama is 10. New Business License and Tax Remittance Mailing Address Read Full Notice.

2519283002 2519435061 2519379561 fax 2519726836. Hydroelectric Kilowatt Hour Tax. Please call the Sales.

Access directory of city county and state tax rates for more taxes. Direct Petition for Refund. Business License Application.

Add the date to the template using the Date feature. Laurel Avenue Foley AL 36535. Effective March 1 2021 the City of Foley will begin self-collecting.

Click the Sign button and. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. However However pursuant to Section 40-23-7.

Be sure the data you add to the Sales Tax Form 12 - City Of Mobile - Cityofmobile is updated and correct. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. This is the total of state county and city sales tax rates.

City of Mobile Alcoholic Beverage Application. 2519283002 2519435061 2519379561 fax 2519726836. City of Mobile Business LIcense Overview.

Sales Tax Form 12. Seller Use Tax Tax Form 13. Effective JUNE 1 2022 please begin remitting sales business tax and business license returns and payments to.

We dont currently make this. Monday through Friday 8am-5pm. Risk Free for 60 Days.

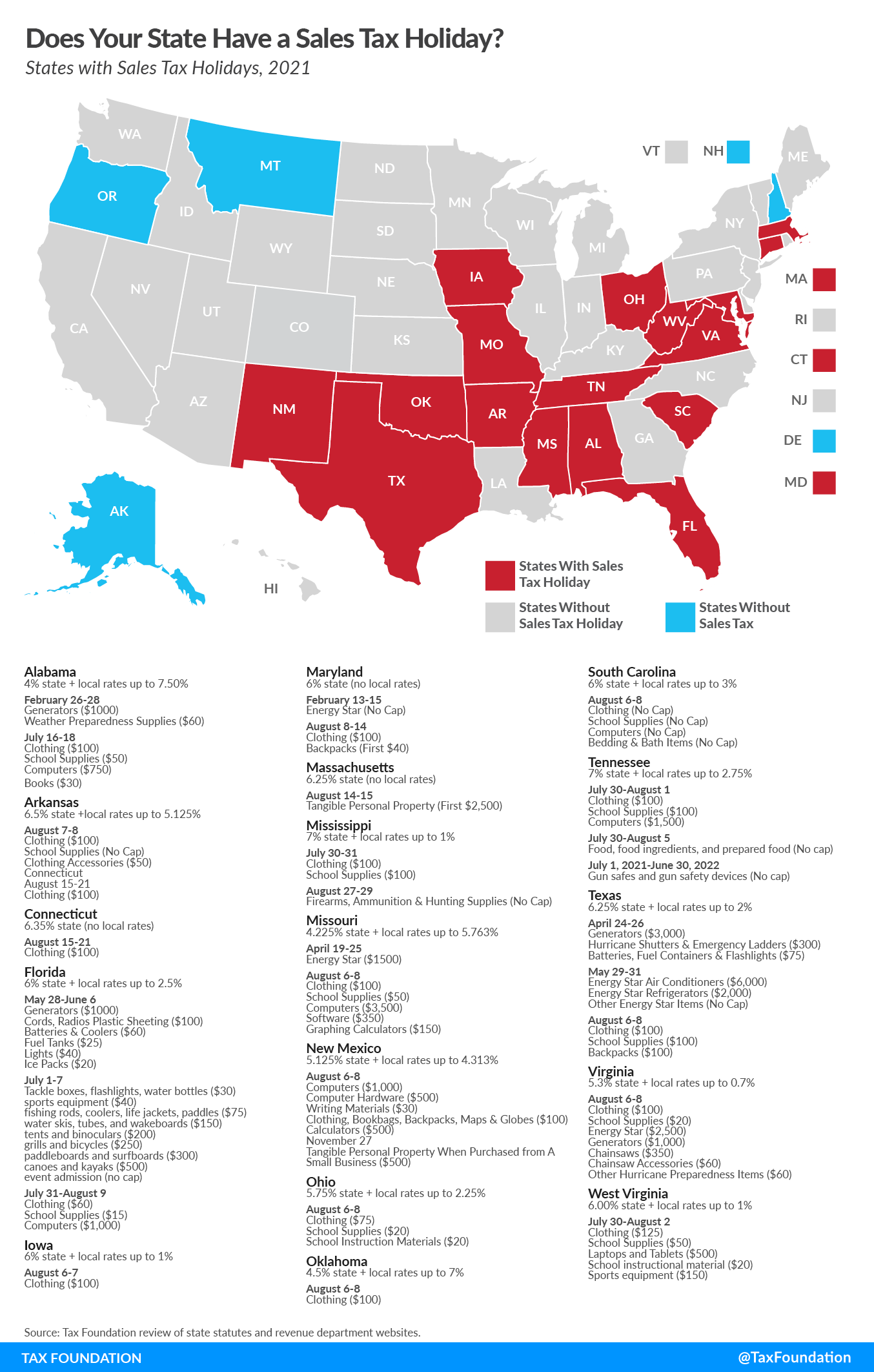

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

What Is A Shared Responsibility Model In Software As A Service No Response Software Service

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

How To Charge Sales Tax In The Us 2022

How To Charge Sales Tax In The Us 2022

Mobile 971 55 971 55 Telephone 971 4 2500251 Email Sa Website Www Fa Uae Hotel Building Office Entrance

Sales And Use Tax Rates Houston Org

How To Create A Tax Client Information Sheet Download This Tax Client Information Sheet Template Credit Repair Business Small Business Plan Business Template

What Is Sales Tax A Complete Guide Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales And Use Alabama Department Of Revenue

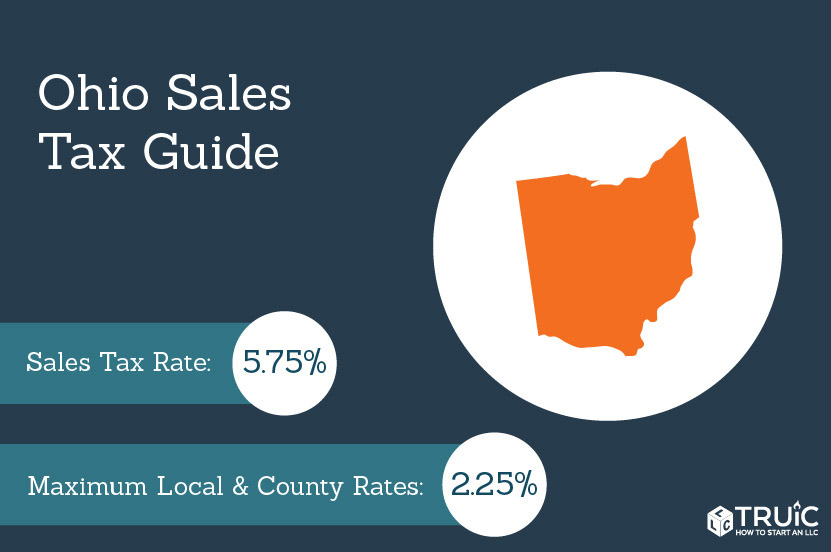

Ohio Sales Tax Small Business Guide Truic

Tax Rates Org The Tax Information Portal Tax Forms Property Tax Income Tax

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Chicago Tax